By Lily Dohmen

We all know that overcoming trials and conflict is part of what makes a good story. If you bought tickets to see a superhero movie in which the hero has no villain to fight and lives in a world where nothing ever goes wrong, you’d ask for your money back.

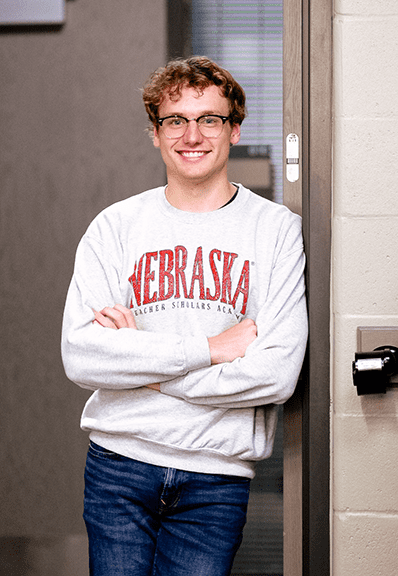

It turns out what makes a good story in the movies also makes a good story in real life. For University of Nebraska-Lincoln sophomore Marlana Saalfeld-Green, trials have been a part of her journey. But, thanks to donors, she’s been able to overcome them.

Saalfeld-Green grew up in a single-parent household and spent a lot of time with her grandparents while her mother worked two jobs. Although she is grateful for the sacrifices her family has made to put her in a position to succeed, she was still at a disadvantage.

A recent study published in the journal Education Next found that teens who lived in a single parent household were 26% less likely to graduate from college by the time they were 24 when compared with those from a two-parent household. One of the main factors was finances. Thankfully, Saalfeld-Green found financial and moral support.

Because her grandparents didn’t attend college and her mom was a non-traditional college student, their perspective was valuable in communicating to Saalfeld-Green the importance of pursuing an education after high school. “My grandparents, along with my mom, told me I needed to go to college,” Saalfeld-Green said. “They wanted me to get an education past my high school degree.”

Thanks to donors, she was able to make it happen. Scholarships through the College of Education and Human Sciences have paved the way for her to become a teacher when she graduates. “My life would be significantly different if I didn’t have support from donors,” Saalfeld-Green said. “UNL has been a place where I can spread my wings by getting involved in college activities. I feel included here.”

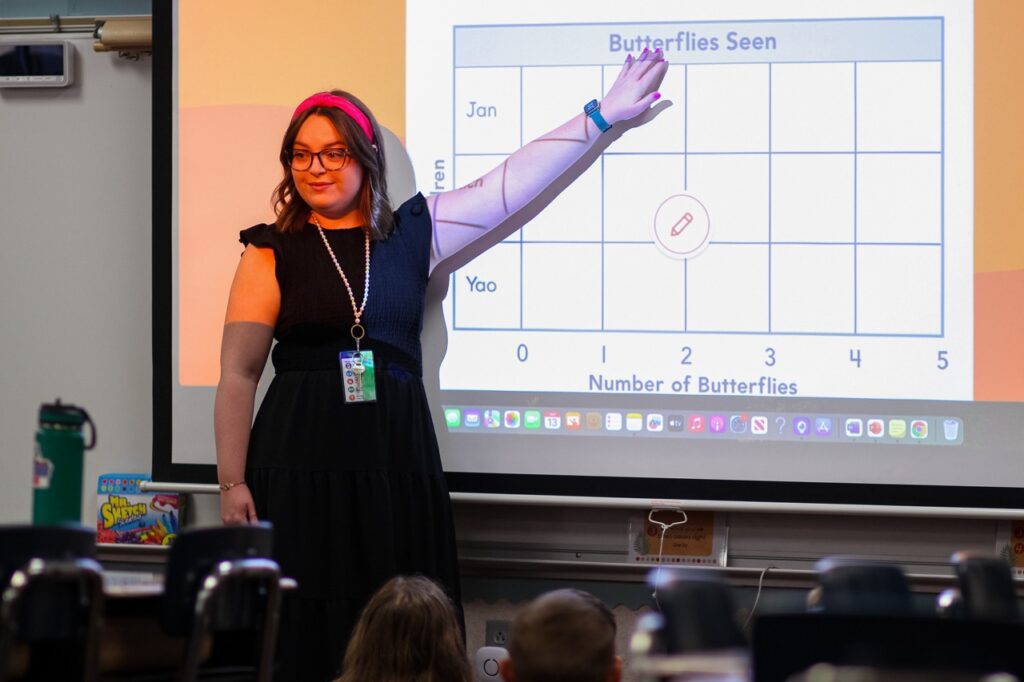

Saalfeld-Green knew she wanted to be a secondary education teacher because she wants to promote diversity and inclusion in the school system. From previous experiences in high school, she was, at times, frustrated with how her teachers treated her. “In my classroom, I want to build a community where everybody feels respected to share their viewpoints, no matter what background they come from,” Saalfeld-Green said.

Saalfeld-Green is currently a Senator for CEHS, Vice President of the Future Teachers of Color Club, Senator of the Association of Students of the University of Nebraska and a member of the Institute for Inclusive Innovation. Many of the clubs and organizations CEHS offers students are also donor funded.

Even though we will likely never write a superhero movie, we can all play a meaningful part in an ongoing real life story. Trials like the ones Marlana Saalfeld-Green faced will continue to challenge students in our communities. We can help them overcome these trials and conflicts by providing them with much needed financial relief.

To see more students like Marlana Saalfeld-Green succeed, consider making a gift of any amount to the College of Education and Human Sciences.

Support the College of Education and Human Sciences

A gift to this fund provides much needed general support for the college to assist areas and programs of greatest need.

Support Education & Human Sciences Scholarships/ Fellowships

This fund shall be used to promote the mission of the College of Education and Human Sciences at UNL.

My life would be significantly different if I didn’t have support from donors.

Marlana Saalfeld-Green